Berlin Makes the Money Go Round

With more than four hundred fintech companies, Berlin is facilitating transactions all over the world.

Digital and disruptive – these are the key concepts that innovators are bringing to the crusty banking landscape. Entrepreneurs want to make financial structures and processes easier and more transparent, applying automation to things like loans, payments, or investment models, merging ideas with tech to make purchases and trade faster and more convenient. This drive is revolutionizing the finance sector all over the world, and in Berlin in particular. The Berlin startup map shows over 400 fintechs.

Investors are keen. In 2018 and 19, fintechs (financial services technology companies) in Berlin gathered approximately 1.8 billion Euro in investment and venture capital, which is 70% of all investment made in German fintech in that period. In 2020 it was another 342 million, and in the first half of 2021 a staggering 1.6 billion. This puts Berlin in fifth place in the global city ranking for fintech investments, behind San Francisco, London, New York and Palo Alto.

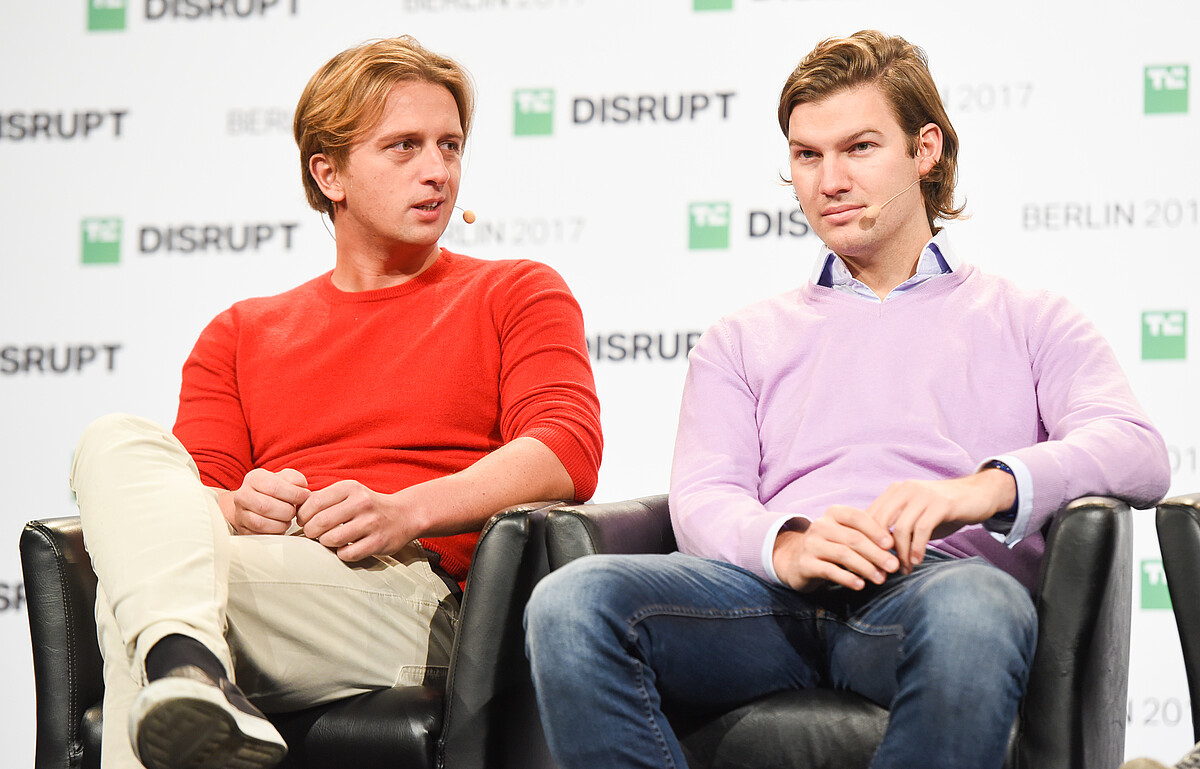

Over a third of all German fintechs are based in Berlin. Some of the first companies to set off this trend were the crowd-investment platform Companisto, fintech company builder Finleap, and the online bank N26. Raisin, Ratepay, Solarisbank (spawned by Finleap), and Trade Republic soon followed.

Some traditional banks and financial institutions sit in Berlin, such as Berliner Sparkasse, Berliner Volksbank or Landesbank Berlin, DKB, and Norisbank. But most bank headquarters are in Frankfurt, and so are the stock market and the European Central Bank.

However, since many fintech companies have their own banking license, they are not dependent on traditional banks and therefore do not require proximity to them. Moreover, financial market regulations are determined by the government, which sits in Berlin, and there may be some advantage to being close to the decision makers in the capital. And then there’s blockchain, the new technology with huge ramifications for the finance sector. Most of the companies and institutions developing blockchain are in Berlin too.

The difference between frontend and backend has its analogy in fintech. The technology behind an intuitively usable finance app is key – who provides it and who facilitates the transactions is not immediately apparent to the parties whose money is moving about. For companies to realise their ideas, it may be easier to plug into extant APIs or to form partnerships rather than develop proprietary technology. One important technology provider is Mambu with its SaaS cloud banking platform.

People Make Startups

If you are a financial institution thinking up a digital product or spin-off, or an entrepreneur with an idea, or a tech platform, or an infrastructure provider, you will consider carefully where to settle. Where the money is, or where the banks are, is not the most important criterion for fintech development.

All growing startups need techies and other skilled staff, and many of these prefer to live in Berlin. Not only because of the quality of life, also because Berlin offers exciting startup jobs. Startup builder Rocket Internet has some fintech ventures in its portfolio, such as Lendico or Zencap (which turned into Fundingcircle). Many more prominent startups, such as Helpling, Delivery Hero, and Zalando, reside in the capital, drawing in all sorts of entrepreneurs as well as young talent looking for jobs in cool young companies.

An added factor is perhaps the image loss that old school banking has experienced, in particular since the financial crisis of 2008. Many young people, be they developers or project managers, consider fintech startups more attractive and dynamic employers than a huge banking dinosaur with its own skyscraper in ‘Mainhattan’ (as central Frankfurt is sometimes referred to). Indeed, a cool fintech startup might not even be equated with a traditional bank, though they operate in the same sector.

And there are plenty of networking opportunities for people into fintech in Berlin, not least the fintech “Stammtisch”, a regular meeting of like minded individuals putting the fun into fintech.

Look Who’s Coming

Some foreign banks like JP Morgan or Rabobank have branches in the German capital. And now some big financial services providers are coming too.

Russian digital bank Tinkoff, an inspiration for N26, has founded a base for their new banking app Vivid Money in Berlin. Solarisbank is providing the infrastructure for this app aimed at the western market. Vivid features unlimited sub-accounts users can maintain for different purposes and in various currencies. There’s also a cashback program, providing up to 10% cashback when users shop at certain major supermarkets or bookstores or subscribe to particular streaming services. The sum is not paid onto the account, though, but is referenced to the shares index of major companies such as Apple or Tesla. The cashback sum users have collected rises and falls with the value of the shares, but never goes into minus. Vivid hopes that since users can’t lose and can only win, they’ll change to the Russian provider.

The British smartphone bank Revolut operates in a similar space. They are now opening a technology center right in the middle of Berlin on Friedrichstrasse. Revolut chose Berlin as the location for their ‘tech hub’ because, according to their CTO, “there’s an unbelievable amount of technical talent in Berlin.” They’re going to be working on trading apps and finance apps for children!

Even bigger and also in the center of Berlin is Klarna’s new tech hub, from which the Swedish payment giant wants to develop more financial products and services for Europe and the US. More and more online shops offer the Klarna instant transfer payment method, and more and more customers are using it. The brand name is becoming increasingly well-known in the German-speaking world and beyond, and at 46 billion US dollars as of June 2021 Klarna has the highest valuation in Europe of fintechs not listed on the stock exchange.

Brexit Brain Drain and Berlin Fintech Hub

London has suffered due to Brexit, with fintech startups noticeably reluctant to settle there since 2017. Ironically, Britain leaving the EU has given Berlin a boost in this respect at least. While Berlin is not a financial centre, it is a fintech hub. The Global Fintech Index 2021 lists the German capital at first place in the EU, ahead of Amsterdam, Stockholm and Frankfurt.

Berlin’s suitability for fintech is not merely due to it being a startup city. Creating value chains that are potentially global is not just a matter of digital tech in any sector, but financial services are especially challenging since fintech companies are more dependent than most on policy and regulatory practices in the territory. So being startup friendly is not enough to be fintech friendly.

To sum up, we’ll quote The Global Fintech Index 2020 on the subject of the kind of ecosystem fintechs need. The people matter, the authors write. “A strong talent pool is key to fintech success but so is a fun location with a global vibe.” Berlin provides both.

Text: Olaf Bryan Wielk, ideenmanufaktur

Header image: © Shutterstock