FinTech as a Transfer Tool

Revolutionising Finance, Nurturing Sustainability: Berlin’s FinTech Story

One of Berlin’s most valuable assets lies in its unparalleled ability to attract and retain top talent. With over 110 universities, colleges, and research institutions, the city consistently produces a stream of highly skilled graduates in fields like computer science and business. Berlin’s pull extends globally, drawing in international professionals and graduates enticed by its vibrant cultural scene, affordable living costs, and exceptional quality of life. The diverse and international workforce in Berlin brings together a multitude of perspectives, fostering a culture of innovation and creativity, whilst ensuring new knowledge from academia and overseas is continuously channelled into the industry. In the next of our FinTech article series, we delve into the intricate dance between academia, industry, and FinTech companies, exploring how this interplay acts as a catalyst for sustainable economic transformation.

Knowledge Flows, Knowledge Grows: Berlin’s FinTech Capital Unveiled

In the first article in our series, we established Berlin as the undisputed FinTech capital of Europe, celebrated for its multifaceted and dynamic nature. The FinTech industry, nestled within a supportive ecosystem, provides an ideal breeding ground for translating fresh ideas and knowledge from academic institutions into tangible business applications. A common avenue for knowledge exchange in Berlin is through local and international graduates finding employment at FinTech companies. However, the transfer of knowledge isn’t confined to conventional paths; many students embark on their FinTech ventures before graduating. Berlin’s universities offer startup accelerator programs, like “Science & Startup” managed by the city’s four major universities. This facilitates access to cutting-edge research, infrastructure, incubator space, scientific mentors, co-founder collaborations, grants, and coaching. The program isn’t exclusive to current students; staff and graduates can also partake, free of charge. A shining example of this symbiotic relationship between academia, government, and industry is “Goldmarie Finanzen”, a FinTech startup founded by two female mathematics and computer science Ph.D. graduates. This startup offers individual stock portfolios continually optimised for risk and return, all while ensuring sustainability.

Lifelong Learning and Collaboration

Seasoned professionals aren’t excluded from the loop, as Berlin provides ample opportunities for them to engage with academia. Numerous events and conferences, such as the annual Transfer Week Berlin-Brandenburg, serve as vital conduits for the exchange of ideas and technologies. This week-long event brings together science, businesses, and innovators, fostering collaborations. The opening conference serves as a cornerstone, uniting decision-makers, and stakeholders across Berlin’s diverse ecosystem. In the current year, the conference centred around knowledge transfer in key sectors like Artificial Intelligence, FinTech, Industry, and Health.

Bridging the Gap: Two-Way Knowledge Transfer

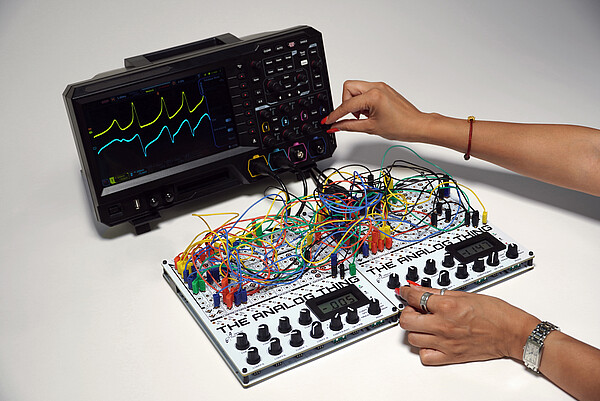

This knowledge exchange, however, is not unidirectional. The FinTech industry itself often becomes the experimental ground for researchers. Given the dynamic nature of FinTech, it becomes a real-world testing arena for novel ideas and concepts, providing academia with invaluable insights for evaluation and refinement. This two-way knowledge transfer ensures a symbiotic relationship between Berlin’s vibrant FinTech landscape and the academic realm. A notable example is a recent study from Excelia Business School in France, where panel data from 66 countries for the 2010 – 2021 period was collected and analysed to assess the impact of FinTech companies on sustainable economic growth. The study concluded that FinTech is a valuable technological toolbox that improves sustainability. For instance, one insight highlighted the real-time monitoring capabilities of FinTech, demonstrating its effectiveness in enforcing environmental laws. Such insights are crucial for policymakers, providing evidence to garner more support and funding for FinTech initiatives, ultimately fostering the growth of the industry.

FinTech and Sustainability: A Necessary Marriage

But what do they mean by FinTech’s real-time monitoring capabilities? Essentially, FinTechs play a pivotal role in fostering sustainability through two major direct avenues. Firstly, they leverage cutting-edge technologies such as advanced data analytics and machine learning to gather, process, and analyse extensive ESG-related data. This empowers investors with ESG scores and ratings, enabling them to make informed decisions and assess the sustainability performance of companies. Secondly, FinTechs contribute to sustainability through impact investing platforms, connecting investors with opportunities aligned with social and environmental responsibility. These platforms provide transparent information about the impact of investments, integrating ESG standards and calculations rooted in scientific principles. Some offerings even incorporate behavioural science, encouraging customers towards a more sustainable lifestyle.

FinTechs also play a pivotal role in fostering a more sustainable economy through indirect means, particularly in the digitisation of German SMEs. In areas such as bookkeeping, innovative FinTech solutions automate traditional accounting processes, reducing errors, enhancing accuracy, and minimising paper usage. Simultaneously, FinTechs contribute to the complex digitisation of payroll for SMEs, streamlining payments, tax calculations, and compliance procedures, fostering accuracy and sustainability. Moreover, in liquidity management, FinTech tools provide real-time insights, enabling informed decision-making and optimising working capital. This not only enhances financial sustainability but also reduces the need for extensive manual analysis, promoting efficiency and resource conservation.

We have witnessed a comparable revolution in the Financial Services industry itself. FinTech has not only revolutionised traditional aspects like mobile payments, digital banking, and blockchain-powered transactions, but it has also elevated accessibility, efficiency, and security in financial services. This transformation has reshaped the industry’s landscape, fostering greater inclusivity in financial access for both individuals and businesses. More significantly, FinTech has played a pivotal role in propelling the industry towards sustainability, giving rise to new sectors, notably ESG investing and sustainable finance.

Elevating Berlin’s Stature: A Hub for ESG FinTechs and SME Solutions

Berlin stands at the forefront of the global FinTech revolution, not merely as a hub for innovation and knowledge exchange but as a pivotal player in the realm of ESG FinTechs. In the 2022 ESG FinTech Report, the consultancy firm EY identified 20 ESG FinTechs in Berlin ranking the German capital second in Europe, right after London. Among these, Ecolytiq leads the charge by integrating climate engagement into banking experiences, applying insights from behavioural science. Another standout is Atlasmetric, a Fintech company that aids companies and financial institutions in seamlessly collecting, managing, and reporting ESG data in alignment with the world’s leading standards. Atlasmetric's platform, built on the Greenhouse Gas Protocol (GHG Protocol), is a testament to Berlin's prowess in leveraging academic expertise for real-world impact.

In the landscape of carbon offsetting, Klima emerges as a noteworthy player, providing customers with access to carbon offsetting projects. Their meticulous process, backed by scientific rigour, ensures a genuine contribution to environmental well-being. Notably, Berlin’s influence extends beyond ESG FinTechs to encompass solutions tailored for the digitisation of German SMEs. Puls, for instance, offers a digital treasury solution covering liquidity management, non-banking financing, and payments. Berlin’s FinTech ecosystem, epitomised by these innovative players, positions the city as a focal point for ESG-driven financial technologies and cutting-edge solutions catering to the unique needs of German SMEs, aiding them to become more sustainable.

Promoting Sustainability, Staying Competitive

Berlin’s FinTech narrative extends beyond revolutionising finance; it’s a story of nurturing sustainability and shaping a future where financial technologies play an active role in fostering a more sustainable economy. This holds particular significance for German SMEs, the backbone of the fourth-largest economy globally. Integrating FinTech solutions into their business processes is not only pivotal for the transition to a sustainable business model but also essential for maintaining competitiveness in the global market.

Text: Günther Petelin

Header image: © Adobe Stock