Receivables Receiving the AI-Treatment

One more in our series of ‘Innovations Made in Berlin’. This time the startup shaking up their industry is PAIR Finance.

Let’s face it, nobody likes debt collectors. Stephan Stricker, founder and CEO of PAIR Finance, is out to change the image behind accounts receivable and claims management. His company is proving that reminding consumers to pay outstanding bills can be a friendly – and automated – business.

Let’s hear him put it in his own words.

This series is called “Innovations made in Berlin”. What is your innovation? When did it originate, and where? Can you describe the place, and who was involved?

We are PAIR Finance, the Berlin-based fintech that rethinks debt collection. Our story short: I myself had previously worked in the marketing industry for a long time. I asked myself: Why aren’t collections actually treated as the important part of the customer journey that they are? This was the start of PAIR Finance. Together with my team we created a revolutionary approach to receivables management. With a specially developed AI technology and in interaction with behavioral psychology and data science, we achieve the highest possible realization rates for our customers, such as Zalando, Klarna or Sixt, but without burdening their valuable customer relationships. We are the market and technology leader in this field.

What do you sell and why should someone buy it?

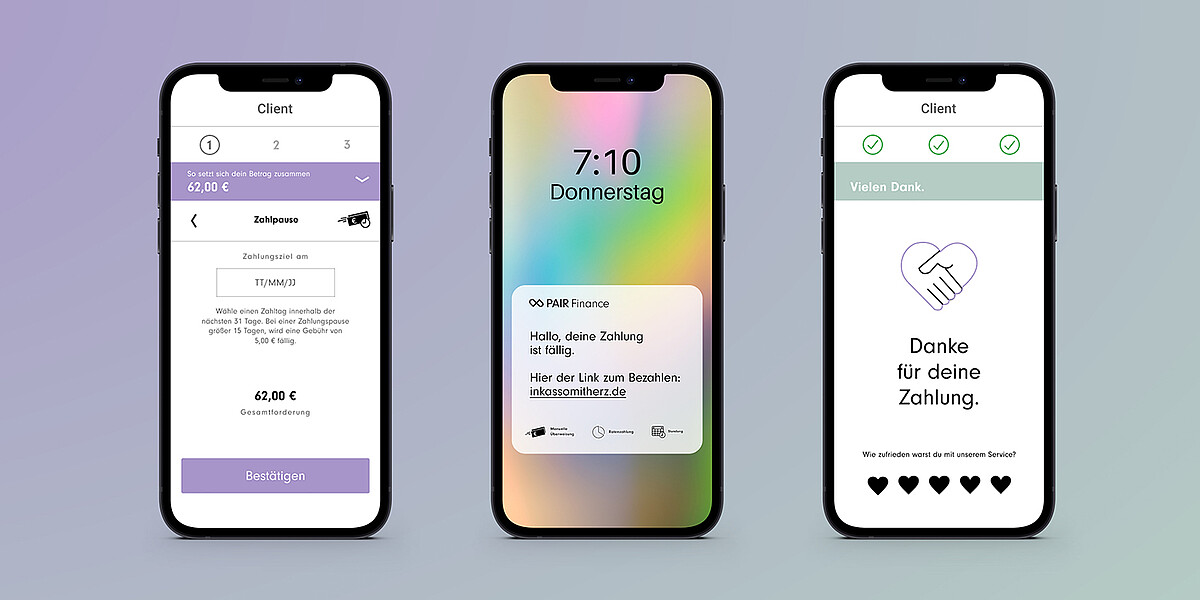

Our vision is to change the debt collection industry in Europe by making receivables management sustainably digital, efficient, and customer focused. PAIR Finance helps companies in recovering lost revenue from unpaid invoices. To ensure that outstanding debts do not become a financial problem for companies, we take on the task of getting the money. We don’t only work within the fixed legal frameworks in debt collection, we want to be better. We use modern, digital communication via SMS, email and WhatsApp instead of letters, which makes collections self-determined. Everyone receives the individual solution offering that suits them. It’s a completely new approach to debt collection. So we use smart technology and psychological knowledge to help people settle their outstanding bills and get out of debt as personally as possible.

How did you find funding for PAIR Finance?

The collection industry is a very old-fashioned and analog industry. And it struggles with a negative image. So there was a great potential for disruption. Early on, we made a name for ourselves with well-known brands that wanted to work with us to rethink debt collection. Back in 2017, our business idea immediately convinced Zalando, several VCs and well-known business angels.

“Don’t develop forever but go to the market with your product and earn money there.”

What advice that you got at an early stage helped you the most while starting and growing your business in Berlin?

Don’t develop forever but go to the market with your product and earn money there. Only if someone is willing to pay money for your product will you finally create value with your product.

How did you manage to establish contacts to potential clients?

At the beginning it was a challenge to gain the trust of the potential clients in the market, because we were young and unknown and we thought about debt collection in a completely different way. We believe debt collection is a financial service and it needs to cater to both clients and consumers. Ultimately, we convinced customers by delivering on our promise: We offer debt collection for the 21st century and work across all industries, primarily for companies driving the digital transformation in society. For example, companies whose customers store, bank, or car-share online are in good hands with us. We currently have more than 350 well-known business customers, including Zalando, Sixt, ShareNow, Home24, [the insurance company]Versicherungskammer Bayern and [adventure experience vouchers provider] Jochen Schweizer.

What do you want to achieve in the next six months?

We are pursuing a clear growth strategy. Our medium term goal is to become the largest service provider for AI-based debt collection in Europe. Customer growth is therefore at the forefront, as is verticalization into increasingly digital industries. Specifically, we plan to expand internationally into further European countries and strengthen our location in Austria. We will also expand our technology into an international self-service platform for clients. And we will continue to develop our AI technology, particularly in the areas of deep reinforcement learning and natural language processing.

How do you find the right people to work with?

PAIR Finance serves the larger purpose to improve not only recovery rates but also the lives of individuals. We created PAIR Finance to change the mindset around collections into that of recovery and consumer-orientation. Currently we have 180 employees and we are looking for people who want to join us on that journey. It is a candidate driven market right now, candidates have a big amount of options today. We see people increasingly care about where PAIR Finance is going in the long term, so that’s valuable. For us, effectively communicating that we are mission-driven is critical to attract and retain top talent.

What is the biggest challenge for PAIR Finance right now?

It is always a challenge to remain an innovation leader, to implement new ideas technically quickly. To achieve this we need the best employees and it is always a challenge to find the best employees on the market.

“The heart of the German fintech scene beats in Berlin.”

What is your reason why Berlin is the place to be?

The heart of the German fintech scene beats in Berlin and there's an unbelievable amount of technical talent and a young, international environment.

What have you personally learned so far on this journey?

Stay focused. Execution must be the most important driver for your business.

Thank you Stephan, you certainly gave us our money’s worth!

Look out for the next Innovation Made in Berlin.

Interview: Olaf Bryan Wielk, ideenmanufaktur

Header image: © PAIR Finance